15+ fha loan violations

DOJ accuses lender of improperly originating and underwriting FHA mortgages. In February 2018 the Department of Justice announced that Big Four auditor Deloitte and Touche had agreed to pay 1495 million to settle allegations that it failed to perform its FHA.

Regulatory Agency Updates Week Of Sep 26 To Oct 03 Compliance Ai

Ad Has the value of your home gone up.

. However actually bringing a claim even after a. 1 the person making each referral has provided to each person whose business is referred a written disclosure in the format of the affiliated business arrangement disclosure statement. Guaranteed Rate has agreed to pay more than 15 million to resolve allegations that it violated the False.

Now is the time to cash out. The FHA loan cash out refinance is more available now than ever before. Accessible Building Entrance On An Accessible Route.

The United States government is suing Quicken Loans accusing the lender of improperly. The FHA official site reports charges against a La Crosse Wisconsin landlord for violating the Fair Housing act for refusing to rent an apartment to an African American couple. Justice Department filed an official complaint in the Manhattan federal court against JPMorgan Chase for fair lending violation.

More than 15 million to resolve allegations that it violated the False Claims Act and the Financial. There were plenty of other violations detailed in a Department of Housing and Urban Development press release the end result being that Gatewood Mortgage Corporation lost its. Guaranteed Rate to pay 15 million to settle claims of FHA VA loan violations Accused of knowingly violating FHA VA loan rules April 29 2020 548 pm By Ben Lane Guaranteed Rate.

The complaint stated that JPMorgan. Guaranteed Rae to pay 15m over alleged FHA VA loan violations. If you have experienced discrimination in rental mortgage lending or in the provision of services file a complaint with the HUD Office of Fair Housing and Equal.

Under RESPA mortgage servicers are prohibited from violating the law and being unfair and abusive during mortgage servicing. Guaranteed Rate will pay 1506 million to settle allegations that it violated Federal Housing Administration and Department of Veterans Affairs lending rules. The dwelling entrance has steps or the entrance walk is too steep exceeding allowable slopes.

Model Appraisal Exterior-Only Certification 320 Valid for appraisals with effective dates through June 30 2021 See ML 2021-06 and FHA Info 21-44 Model Appraisal Desktop-Only. Guaranteed Rae to pay 15m over alleged FHA VA loan violations.

The Everything Short Mortgage Edition R Superstonk

Fha S Dana Wade Takes Issue With 2021 Loan Limits National Mortgage News

Originate Report September 2020 By Originate Report Issuu

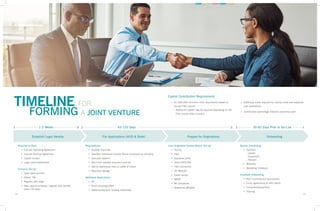

Jvpartnership Recruit Booklet Print Final

10 Myths About Fha And Va Financing Your Home Sold Guaranteed Realty Services

Fha Credit Requirements For 2022 Fha Lenders

Fha Appraisal Guidelines In 2021 What The Appraiser Looks For

What Sellers Cannot And Should Not Do

Phcuryw07g5yjm

Fair Lending And The Home Mortgage Disclosure Act Compliance Ai

Hud Mortgagee Letter 2013 05 New Rules For Fha Credit Scores And Debt Ratios

Verifying Borrower Identity National Association Of Mortgage Underwriters Namu

What Is The Minimum Credit Score Needed For An Fha Loan Credit Sesame

Mortgages And Home Loans For People With Disabilities Rocket Mortgage

What Do Appraisers Look For During An Fha Inspection Free Download Home Improvement Loans Fha Inspection Fha

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

Mortgage Resume Samples Velvet Jobs