Selling business tax calculator

Discover deferred sales trust resources to help you save on your business sale. Our sales tax calculator will calculate the amount of tax due on a transaction.

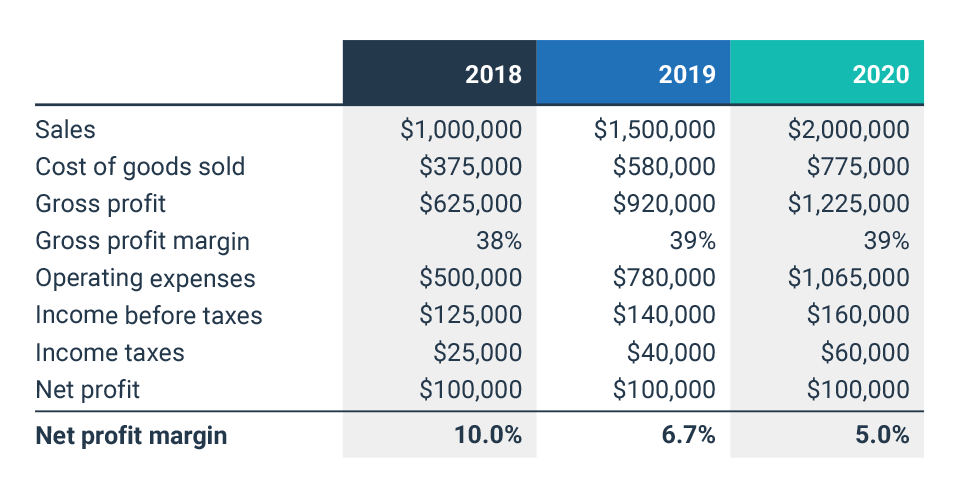

Net Profit Margin Calculator Bdc Ca

The money you make from selling your business assets will be classified as either regular income or capital gains depending on what is being sold.

. The top irs federal personal income tax rate is currently 37 for the highest tax bracket. Multiply price by decimal. Adjust the slider below to estimate your.

You pay Capital Gains Tax if youre a self-employed sole trader or in a business partnership. Use our Small Business Corporation Income Tax calculator to work out the tax payable on your business taxable income. Note that there will always be a discrepancy between the business value based on.

2022 Capital Gains Tax Calculator. This applies to both direct and indirect transfers such as the sale of a business or the sale of a partnership interest in which the basis of the buyers share of the partnership. Choose a business structure.

Buy an existing business or franchise. If youve held it for more than a year youll be taxed at the capital gain tax rate for long. This handy calculator helps you avoid tedious number.

Divide tax percentage by 100. The price of the coffee maker is 70 and your state sales tax is 65. The calculator can also find the amount of tax included in a gross purchase amount.

54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Estimate your potentialtax savings based on yourannual business-related expenses. Profits from the sale of.

We have the SARS SBC tax rates tables built in - no need to look. Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. Calculate your capital gains tax savings with our capital gains tax calculator.

Choose your business name. Pick your business location. Usually the vendor collects the sales tax from the consumer as the consumer makes.

CALL NOW 8008970212. Entrepreneurs relief - which has recently been renamed business asset disposal relief - could allow you to pay a lower CGT rate charged at 10 on the first 1m of gains when selling a. Other organisations like limited companies pay Corporation Tax on profits from selling their assets.

Capital gains taxes may be due on any gain received from the sale of the individuals partnership interest or from the sale of the partnership as a whole. List price is 90 and tax percentage is 65. 65 100 0065.

APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. Use this tool to estimate capital gains taxes you may owe after selling an investment property. The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600.

Use our Small Business Corporation Income Tax calculator to work out the tax payable on your business taxable income. This handy calculator helps you avoid.

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Iqexxkzshldbom

Sales Tax Calculator

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Calculate Sales Tax A Simple Guide Bench Accounting

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Net Profit Margin Calculator Bdc Ca

2021 2022 Income Tax Calculator Canada Wowa Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sales Tax Calculator

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

What Are Earnings After Tax Bdc Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How Much Does A Small Business Pay In Taxes

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

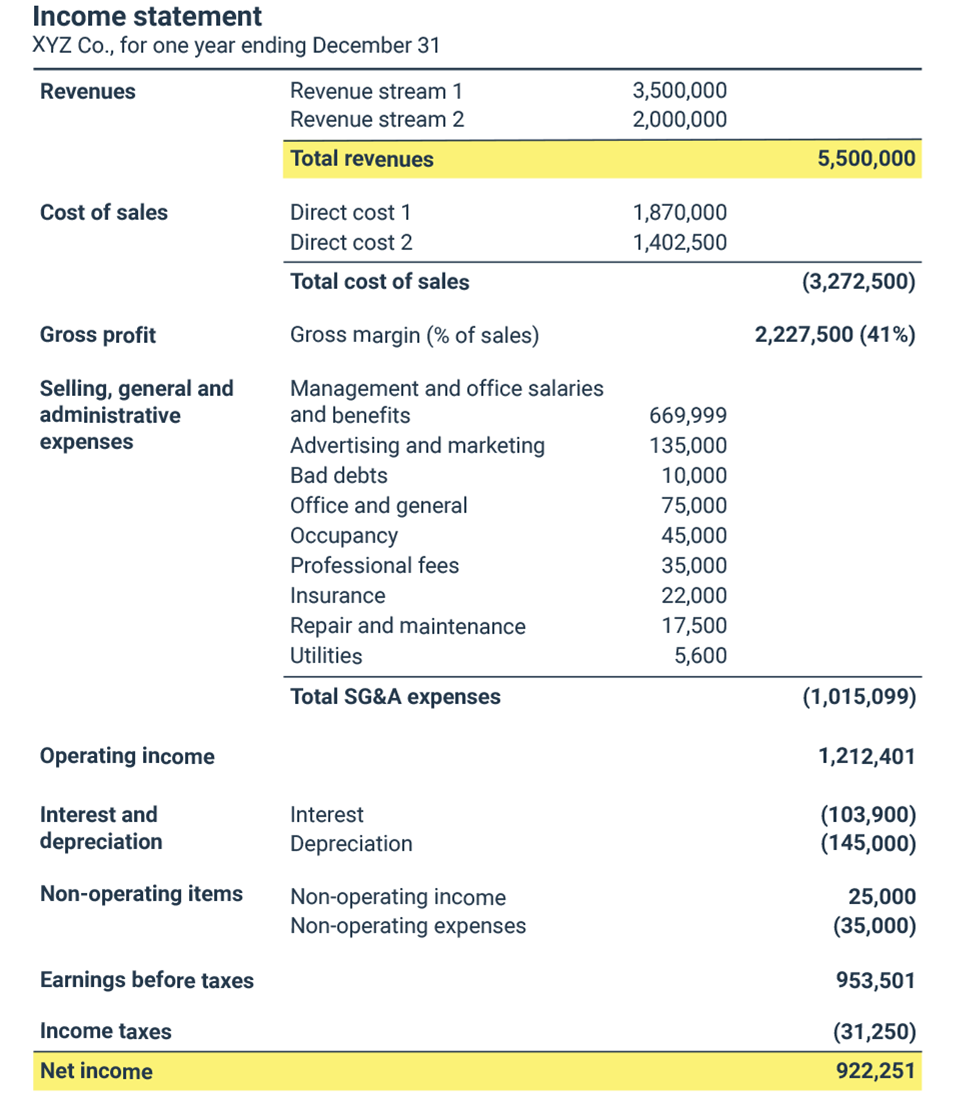

Net Income After Taxes Niat

Provision For Income Tax Definition Formula Calculation Examples